cryptocurrency tax calculator reddit

Benefits of using coin trade ledger as your cryptocurrency trading reporting platform and tax calculator. You can be liable for both capital gains and income tax depending on the type of cryptocurrency transaction and your individual circumstances.

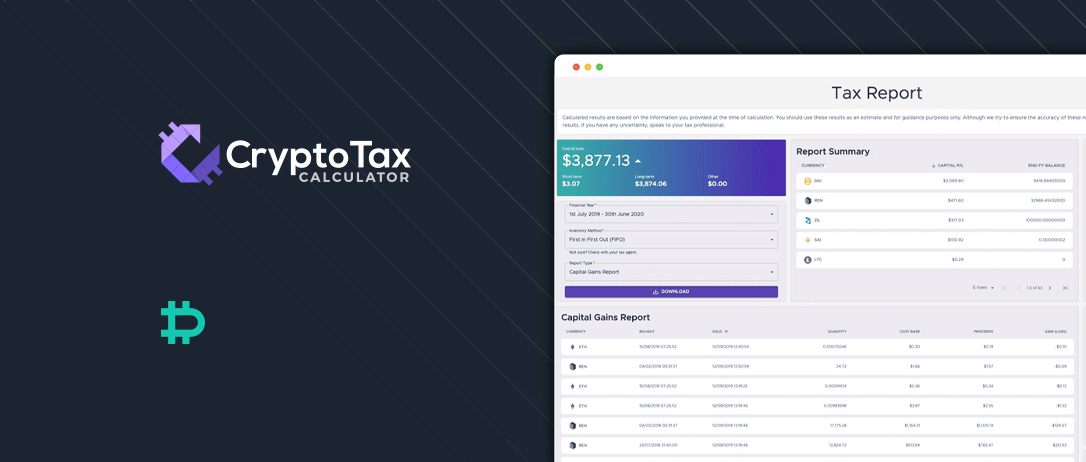

New Partner Cryptotaxcalculator Deribit Insights

And there are plenty of others out there like Crypto Tax Calculator among others.

. Free crypto tax calculator excel. Tax-Loss Harvesting With A Crypto Tax Calculator. Crypto market cap 2111471977943 307.

For example you might need to pay capital gains on profits from buying and selling cryptocurrency. Free crypto tax calculator canada reddit. I tried Googling and using the Reddit search but surprisingly there arent a lot of posts on this.

Gains and losses are calculated in your home fiat currency like the US Dollar to help you file your taxes with ease. In the US crypto-asset gains are calculated using two factors. This subreddit is for UK specific cryptocurrency discussion.

Just by entering a few basic details on the calculator one can ascertain the short or long-term capital gains tax depending on the holding period. Focus should be on UK specific content but we aim to be a free and open place. Bitcoin Taxes is one of the earliest and most popular tax calculators for crypto enthusiasts.

For example you might need to pay capital gains on profits from buying and selling cryptocurrency. You can be liable for both capital gains and income tax depending on the type of cryptocurrency transaction and your individual circumstances. CoinSutra Cryptocurrency 6 Best Crypto Tax Softwares 2022 Calculate Taxes on Crypto Cryptocurrencies brought four main groups together.

It was developed with the. If your crypto tax situation ever gets more complex feel free to try us out at cryptotaxcalculatorio were an Aussie-made crypto tax solution. In terms of Crypto Tax Software out there.

The online platform allows users to import data. Popular Tax Calculators for Cryptocurrency Investors. Proper taxation of cryptocurrency gains and losses.

This is the first time the Indian government is discussing crypto taxation. They compute the profits losses and income from your investing activity based off this data. Whether you accept or pay with cryptocurrency invested in it are an experienced currency trader or you received a small amount as a gift its important to understand cryptocurrency tax implications.

Then I released it on Reddit for free. Discover how much taxes you may owe in 2021. Interest in cryptocurrency has grown tremendously in the last several years.

Note however that first short-term losses are applied against short-term gains and long-term losses are applied against long-term gains. This guide breaks down the implications of cryptocurrency transactions from a tax perspective to put you in a better. The internal revenue service irs recognizes any income generated by trading cryptocurrency or accepting cryptos for goods and services as taxable.

You cant use Specific Identification with cost basis and sale proceeds for crypto from different wallets or exchanges. You will find a lot of opinions on reddit so i class this more as medium risk always do your own research and if you. Tax time for crypto investors can be a nightmare if you havent kept proper records.

Assuming of course youre not trying to avoid paying taxes and get the Tax Man knocking on your door. Your income bracket and how long you have held the cryptocurrency. Not only can we handle 400 exchanges and wallets but we also work with all non-exchange activity such as onchain transactions like Airdrops Staking Mining ICOs and.

Likewise does anyone know the easiest amount to report even if its a slight overestimation. Cryptocurrency tax is a new and emerging space in Canada with much speculation about different crypto scenarios and how they are taxed. In the US the cryptocurrency tax rate for federal taxes is the same as the capital gains tax rate.

In 2021 it ranges from 10-37 for short-term capital gains and 0-20 for long-term capital gains. Cryptocurrency tax calculators work by retrieving data from your exchanges wallets and other cryptocurrency platforms. In general terms losses resulting from cryptocurrency trades are tallied against any gains made in the current year.

Please note that this is not a place for pumping specific coins or disrespecting others. Csv or excel files downloaded from your exchange. How to calculate your crypto tax in Canada.

Looks like you managed to sort it out with Coinbase awesome to hear. When your crypto gains are taxed your cryptocurrency tax rate will be either your income tax rate or lower capital gains rates depending on how long you held the crypto. Cryptocurrency Tax Calculator.

As the cryptosphere gained more traction revenue authorities came knocking and started talking about the need for crypto traders and investors to pay tax. Has the community figured out what the established non-scam tax calculator website we should all be using. Initial purchase price of 5 x 25 units 125.

In my opinion at the tax year end you should NEVER have unrealized losses. Investors traders miners and thieves. The tax will apply to all gains on digital virtual assets and no capital losses will be allowed.

It was developed with the. Koinly httpskoinlyio appears to be the biggest site offering Crypto Tax services. Cryptocurrencys rise and appeal as an alternative payment method.

Remaining units 75-50 25 so we need to include 25 units from the earlier sale to calculate our start balance. The increasing number of people seeking cryptocurrency tax calculator services like the Brunette brothers may also be down to the growing trend of. Business expenses will also not be allowed.

A Bitcoin tax calculator is a tool that helps Bitcoin owners automate the calculator of short-term capital gains tax and the long-term capital gains tax on profit from bitcoins. So unrealized gains 600 - 200125 275. Indian government just announced that crypto will be taxed at 30 of gains.

I Ve Tried Crypto Tax Software So You Don T Have To R Cryptocurrency

22 Best Reddit Personal Finance Communities For Entrepreneurs And Business Owners Personal Finance Finance Finance Guide

Crypto Preneur Is Your Favorite Coin On The List The Stocktwits Platform Is The Largest Social Network Focused On Stock And Cry Borse So High Like4like

How To Prepare Your Crypto Taxes Bittrex Exchange

Bitcoin Taxes Bitcointax Twitter

Ireland Cryptocurrency Tax Guide 2021 Koinly

The Ultimate Australia Crypto Tax Guide 2022 Koinly

What You Need To Know About The Binance Tax Reporting Tool Binance Blog

Easiest Way To Calculate Your Taxes R Bitcoinbeginners

Stal Li Majning Bitkoinov Ubytochnym I Chto Zhdet Majnerov V Budushem Proshlyj God Stal Unikalnym Bitcoin Mining Hardware Bitcoin Mining What Is Bitcoin Mining

Filing Your Crypto Taxes Bittrex Exchange Cryptocurrency Exchange

Explained How Will Crypto Taxation Work In India

Serious How Are You Dealing With Crypto Tax In 2020 2021 R Cryptocurrency

Coinboard On Twitter Bitcoin Crypto Money Cryptocurrency

You Should Know That Crypto Com Have Their Own Free Crypto Tax Calculator R Cryptocurrency

Bitcoin Taxes Bitcointax Twitter

Bitcoin Taxes Bitcointax Twitter

Gbtc Bitcoin How Fo You Buy Bitcoin How To Buy Bitcoin Cash Where To Spend Cryptocurrency Lifetime Bitcoin Mining Contr Bitcoin Buy Bitcoin Bitcoin Mining Rigs

How To Simplify Your Cryptocurrency Tax Keeping Altcoin Buzz